A refined criteria with consistent application

Our investment pursuits are focused on two distinct return profiles and levels of risk: value-add repositioning and long-term durable yield.

Our investors are made up of high net worth individuals, family offices and institutions that are seeking diversification through direct real estate investment as part of their alternative asset allocations.

Criteria Overview

Investments fall in two distinct categories but both offer fundamental attributes that must always be present, we focus on these attributes before pressing forward with any investment:

WELL LOCATION

The best locations within a given market are necessary when attracting any type of occupant irrespective of property type. We focus on diverse geographies throughout the central United States to create exposure to various facets of the economy and reduce concentration risk to a specific industry.

FUNCTIONAL & EFFICIENT

A property must adhere to the needs of the contemporary tenant and be an efficient use of space to afford optionality in leasing opportunities.

HIGH QUALITY

While deferred maintenance is normal and expected on some value-add investments, the property’s construction must be of an institutional nature and be able to withstand the test of time while adapting to changing tenant needs.

BASIS DRIVEN

Basis at the time of acquisition is an enduring attribute required for any successful transaction to thrive, basis allows for leasing flexibility and enhances liquidity during market cycles.

LIQUID

Liquidity in a market is paramount to ensuring a successful disposition at the most advantageous point in any business plan.

SOUND MARKET

To qualify as a fundamentally sound market there must be a consistent level of transaction activity, both in leasing and capital markets, healthy occupancy fundamentals and a limited amount of development potential in the form of vacant land.

Investments and Investors

We apply our criteria to two specific types of investments in order to build long-term returns for a particular range of investors:

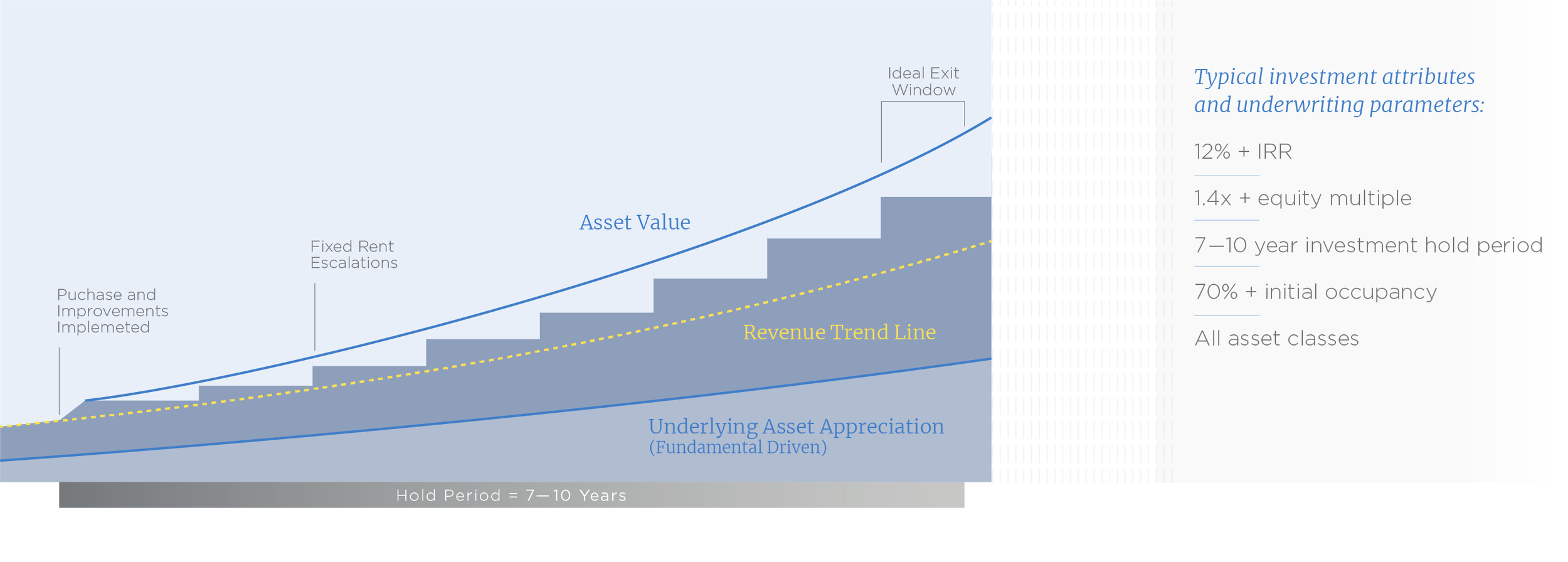

Value–Add Investments

Value-add investments are those opportunities that have in-place recurring revenue but are not operating at their full potential for a variety of reasons, though often because some element of the property is in distress. Value investments have a shorter duration, generally spanning one-to-five years and are concentrated on a specific thesis which is intended to produce enhanced risk adjusted returns. Successful value-add projects generally offer a higher return profile than our durable yield investments however these projects bear more risk.

Durable Yield Investments

Durable yield investments often times called “core” or “core plus” investments and are those that have mid-to-long term income streams and generate recurring annual yields with limited value creation opportunities. These investments strive to strike a balance of current income with underlying asset appreciation, due to their less risky attributes they generally offer a lower return profile than our value-add investments.

Our Investors.

Our investors are a diverse group of high net worth individuals, family offices and institutions seeking direct real state investment as part of an allocation to alternative assets as part of a broader investment management strategy. Investments range in size and are generally specific to each opportunity but range in size from $50,000 to several million dollars. We’ve partnered with most of our investors for decades and believe in fostering relationships over time through methodical capital allocations.